Exchange Rate Risk Is Best Described as

The long-run exchange rate risk faced by an international firm can be reduced if a firm borrows. To illustrate how exchange rate can affect an investor operating in a foreign market.

Pin By Amelia Ivana On Spm Interest Rate Swap Comparative Advantage Finance

Managing Economic Risk T.

. The variability in the current accounts balance of the balance of payments. Unexpected changes in relative economic conditions. A change in the dollar against the pound on the other hand would have a greater effect.

They can short the currency artificially driving its value down. The risk that a positive net present value NPV project could turn into a negative NPV project because of changes in the exchange rate between two countries. The cost of a unit of currency in terms of another.

Foreign exchange risk refers to the losses that an international financial transaction may incur due to currency fluctuations. The type of exchange rate risk known as translation exposure is best described as. The type of exchange rate risk known as translation exposure is best described as.

The variance in relative pay rates based on the currency used to pay an employee. Following are some of the disadvantages of the floating exchange rate system 1. The exchange rate was 1 pound 150 on collection in January of the subsequent year.

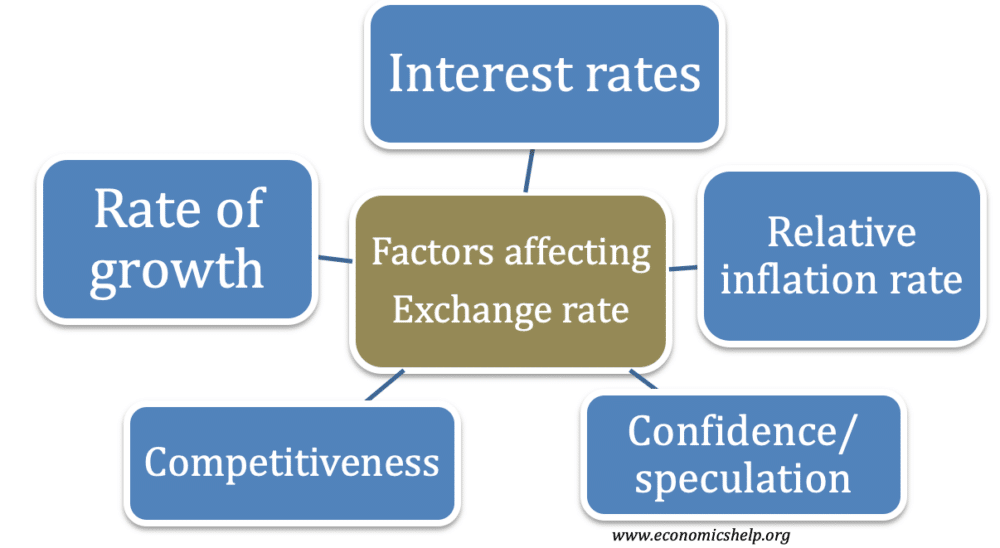

To influence the price of each currency in terms of another currency To develop new currency types To allow individuals businesses governments and other institutions to be able to make andreceive payment across borders To manage floating systemsWhich of the following is a variable that affects exchange rates. Managing Translation Risk The second exchange risk ie translation risk or. At the companys December 31 fiscal year-end the exchange rate was 1 pound 145.

If the company is. Managing Transaction Risks The most common way to manage transaction. They may be expressed as the average rate for a period of time or as the rate at the end of the period.

One potential risk of a persistently undervalued real effective exchange rate REER is an excessively large trade surplus and an economy that could. Exchange rate risk is the possibility that changes in currency exchange rates may affect the value of assets or financial transactions. Risk that a change in exchange rate will affect the business of a company.

But if it went from 13 to 10 the same sales would be worth just 50000 a 15000 loss. If it doesnt have enough foreign currency on hand it will have to raise interest rates. Exchange rate risk is the possibility that the value of an investment will change when the currency is exchanged.

The problem encountered by an accountant of an international firm who is trying to record balance sheet account values. Over-the-Counter transaction OTC where every trade takes place and every trade is a private transaction between bank and client. Upload your study docs or become a.

It is common for exchange rates to be reasonably volatile as they are impacted by a broad range of political and economic events. If the fluctuations in exchange rates are too much it can cause issues with movement of capital between countries and also impact foreign trade. C Exchange rate risk is best described as a.

The following are a few examples of exchange rate risks. A fixed exchange rate can make a countrys currency a target for speculators. Exchange Rate Risk Is Best Described as By Ra_Paris734 12 Apr 2022 Post a Comment Best Places To Stake Stable Coins Tether Usdc Busd Low To Medium Risk What Are Commodities Money Strategy Investing Finance Investing Foreign Exchange Risk Definition.

Also known as currency risk FX risk and exchange-rate risk it. This risk arises from unanticipated changes in the exchange rate between two currencies. Exchange rates are defined as the price of one countrys currency in relation to another.

Foreign exchange risk is also known as exchange rate risk or currency risk. If the rate goes from 13 to 18 those 50000 in sales would be worth 90000 instead of 65000a nice 25000 windfall. The variability of investment returns or prices of goods and services caused by changes in the value of one currency versus another.

Long-run exposure to exchange rate risk relates to. It encourages speculation that may lead to fluctuations in the exchange rate of currencies in the market. The risk that a positive net present value NPV project could turn into a.

Investor buys currency expecting the asset will rise in value. This occurs when there is movement in the exchange rate between placing an order and the transaction being completed. As currency falls against an opposing nation imports become more expensive and exports go.

The variability of investment returns or prices of goods and services caused by changes in the value of one currency versus another. On October 1 of the current year a US company sold merchandise on account to a British company for 2000 pounds exchange rate 1 pound 143. Exchange rates are classified by the International Monetary Fund IMF in three broad categories reflecting the role of the authorities in the.

The type of exchange rate risk known as translation exposure is best described as. Exchange rate risk affects a nations import and export business. The risk that a positive net present value NPV project could turn into a negative NPV project because of changes in the exchange rate between two countries.

In case of exchanges if the company is going to receive a large sum of foreign currency from customers it bears the risk that the currency will depreciate and the company will go short in a currency forward contract. Exchange rate risk is best described as. Exchange rate risk is.

The cost of a unit of currency in terms of another. Currency risk or exchange rate risk refers to the exposure faced by investors or companies that operate across different countries in regard to unpredictable gains or losses due to changes in the value of one currency in relation to another currency. Multinational companies export import businesses and investors making foreign investments face exchange rate risks.

The variability in the current account balance if the balance of payments account. That forces the countrys central bank to convert its foreign exchange so it can prop up its currencys value. The type of exchange rate risk know as translation exposure is best described as.

Pin On Best Investment To Make Money

Exchange Rate Risk Economic Exposure

Automate Email Marketing Tips Smbelal Tips Digital Marketing Automate Email Marketing 2020 Conversion Rate Optimization Conversion Rate Optimization

Comments

Post a Comment